Despite a little over 10 years of a bull market, one of the consistent myths that will not die is that “cash on the sidelines†theme. The ongoing belief is from greed and I call it hopium. This hopium is that at any moment investors are suddenly going to empty their bank accounts and pour them into markets. Many financial presences have pushed this notion, hyping up investors to continue buying. Yahoo Finance has even came out with claims like: “It should also come as no surprise that there’s never been so much cash sitting on the sidelines – nearly $5 trillion, as a matter of fact. This is significantly above the record $3.8 trillion in cash set back in January 2009 during the financial crisis!” This is an old excuse being used again in today’s age as to why the current “bull market” rally is set to continue into the indefinite future.. However, what is it going to take? We’ve had 4 rounds of consecutive QE in the US, a 400% advance in the markets, and a ongoing global QE. One major reason as to why this isn’t a reality is that for every buyer there must be someone willing to sell. As stated by Clifford Asness:

“There are no sidelines. Those saying this seem to envision a seller of stocks moving money to cash and awaiting a chance to return. But they always ignore that this seller sold to somebody, who presumably moved a precisely equal amount of cash off the sidelines.”

Every transaction in the market requires both a buyer and a seller, with the only differentiating factor being at what price the transaction occurs. Since this is necessary for there to be equilibrium in the markets, there can be no “sidelines.”

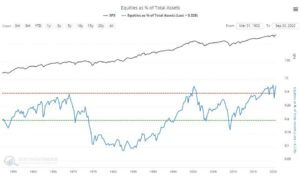

If we want to be sure about this we can look at the stock-to-cash ratios (cash as a percentage of investment portfolios) which suggests there is very little available buying power from investors on the “sidelines†currently. As assets are escalating, so has investors appetite to chase risk. The herd rushing into equities shows that investors have thrown risk out the window, it also means they have deployed most if not all their investable cash.

Of course, once you run out of cash to invest, the next step is to do what we do best and “borrow cash” to increase equity allocations. With professional investors leveraging their bets, there isn’t much excess cash sitting on the “sidelines†around.

To top it off even mutual funds are holding record lows of cash.

With net exposure to equity risk by individuals at historically high levels, it suggests two things:

* There is little buying left from individuals to push markets marginally higher.

* Stock to cash ratio, shown below, is at levels ordinarily coincident with more important market peaks.

The reality is investors are holding very little “sideline cash,” as they have gone “all in” to chase the market higher. The real answer for this is that greed is at all time highs just like the markets, and hopium is a symptom of greed