5 ways to make more money with investing. Yes, it really is that easy. I am going to show you key principles, five of them, that can take you from maybe not making any money to making more money than you’ve ever imagined.

Today, we are going to talk about five simple things that you can do to go from being an average investor to being a great investor. It truly only takes five simple things. I’m going to break them down for you.

WHAT HAS HAPPENED SINCE THE LAST CRASH

Let’s get right into it! So first off, make more money than WHAT? If you’re not aware, which I’m sure you are, we are in a booming bull market. The markets, and I mean all the markets: the stock markets, the bond markets, the housing markets, the gold markets, the crypto markets, and everything in between has been booming for a decade. After the great market crash of 2008, we turned a corner and this bull market has been going virtually straight up for the last 10 years.

VTI AS A MARKET INDICATOR

I want to show you how that kind of bull run could impact even just an average investor with the right strategy. Let’s use this exchange traded fund (ETF) called the Vanguard Total Stock Market Fund (VTI) to illustrate. This ETF is accessible to anybody with a computer and with one click of a button, you can buy this Vanguard ETF. It’s ticker symbol is VTI and when you buy it, you’re basically buying the entire stock market. VTI mirrors the diversification of the entire market.

By buying it, you would have exposure to the same volatility that the stock market experiences on the whole. This fund is as close to the status quo for market performance as an individual investor can get. In this instance, that is a huge. This particular stock- mirroring the market- is up 500%. Five. Hundred. Percent. So, in 2009, if you would’ve just bought that fund, that ETF with one click, you’d be up five-fold since that time. There are, obviously, other funds or strategies that would have allowed that kind of growth, but this is just an example of how good the market has been in the last 10 years.

The market is up 500%. But where do you stack up? Have you made 500% in the last 10 years?

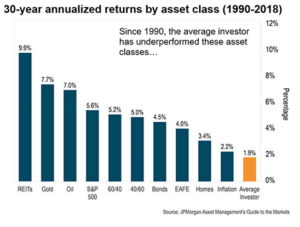

Unfortunately, the answer is likely no. Well, I don’t know about you personally, but for the most part it’s not been the case for the average investor. As a matter of fact, the average investor has underperformed every other asset class.

This graphic compares each individual asset class and what their returns have been to the returns of the average investor.

EMOTION IN INVESTING

In other words, any investor could have put every single penny into any of these single asset classes, walked away, and forgotten about it for 10 years and would have performed better than the average investor in this market. It’s unfortunate. The reason why the average investor has performed so poorly is because of emotions. You’ve heard me talk about this over and over and over again. It’s so important. I want to always make it a point to say that emotion makes humans horrible investors.

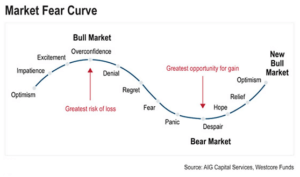

That’s right. Our human nature makes us horrible investors. It’s our emotions. We start investing and we get this roller coaster. We want to buy when the market is at the top and we want to sell when the market is at the bottom. That’s what human nature makes us do.

This is a market fear curve. Notice at the top- there’s the bull market and, then, as it comes back down we are in the bear market. Unfortunately, we’re pretty basic beans, right? Humans are motivated by two things, moving towards pleasure- and -moving away from pain. What does that mean when the market’s going up and everyone’s making money? People want to jump in. Investors want pleasure too! Everyone wants to make money too!

If we jump in and we buy at the top, when the market crashes, it’s painful. It sucks. Nobody wants to lose money. When we are feeling pain, we panic, we sell, and we don’t want any more pain. Do you know what you just did? You bought high and sold low. That’s what the average investor does.

TAKE THE EMOTION OUT OF INVESTING

So how do you beat that? Well, you stay the course. If you want to avoid the mistakes of this and pass on the emotional rollercoaster ride, You. Stay. The. Course. No more jumping in and out. If you are self-identifying as a rollercoaster rider right now, I get it. Staying the course goes against our human nature. As they say: investing ain’t easy. But, if you’ve made those mistakes in the past, it’s time to correct it.

It’s important to remember, don’t be average. We already know the average investor has lost money compared to every other asset class. Don’t be average; be above average. Be better. You can be better. You need to have a plan to crush the market. We’re in the longest bull run in United States history, and you have to be in the market to win. You have to be in it to win it.

Starting right now. It’s pretty simple. You now know that human nature is your biggest obstacle to making the most of your portfolio. Know better, do better. It’s time for me to give you five simple ways that you can be better than the average investor.

DIVERSIFY YOUR ASSETS

Diversify your assets. Above, I showed you that any one of those assets would have done better than the average investor if you had held your position. However, in order to insulate your portfolio from the market ebb and flows, you don’t want to just buy one asset. You want to diversify your assets, right?

Diversifying your assets by multiple asset classes is the best way to build and not only build, but to keep your wealth. Now, I’m living proof that it’s easier to make money than it is to keep it. By diversifying your assets, you could build your wealth and you can keep it at the same time.

Diversification takes the emotion out of investing and helps you to survive those emotional roller coasters. Diversifying across the asset classes ensures that your overall portfolio has less dramatic growth and contraction even though individual assets are moving up and down in concurrence with their position in the market. You have opportunities to invest in different assets like stocks and cash and real estate and cryptos and gold on and on and on, right? A portfolio comprised of many of these assets is how you’re going to get better returns for lower risk.

I have told you my story before. To recap, I didn’t diversify. I lost my entire portfolio back in the last great financial crash in 2008. That’s why I pound the table on diversifying your assets.

So that’s number one

TUNE OUT THE NOISE

Tune out the noise. Shut the radio off, shut the news off, and tune out the noise. We need to forget about short-term forecasts. If I had a nickel for every time somebody asked me “what is the price of Bitcoin going to be next week or next month?” I always answer the same thing. I don’t know. And, frankly, I don’t care. I care where Bitcoin is going to be in two years or three years from now. I don’t care where it’s going to be in a week or two because I’m not a day trader. Again, forget the short-term forecast because nobody knows. Nobody has a crystal ball.

I don’t know where gold is going to be in a week or two or a month or two. What I do know is that central banks are buying more gold today than any time since 1971 when we had the gold standard. We know that gold is going up over the long-term. Investors can look at the financial system collapsing, but gold is going to continue to go up, right? The long term outcomes are resonably predictable, but it’s time to remove the emotion and forget the short term. It’s time to turn off the noise.

If you’re watching the news you see Trump this and China that and trade wars this and stocks have been tumbling that. All this noise sends the average investor into a panic. Average investors start selling their stocks. But, we know better, right? We will focus on the trends, the strong underlying currents and ignore the noise.

RISK MANAGEMENT

Risk management is number three and it’s a big one. It’s especially important for me after losing all my money in 2008. How do you practice proper risk management? Risk management isn’t just a strategy, it’s a necessity. You need to practice risk management to not only grow your wealth, but also to protect and keep your wealth. The best way to make money is to make sure you never lose money. The best practice for proper risk management is through allocation.

As stated above, you need to diversify through multiple assets, but we also need to consider position sizing. In other words, when I allocate each position, I want to use position sizing within that allocation to make sure I’m not risking too much. For example, if I am going to buy some emerging market stocks- where I’m going to buy cryptocurrencies, I am going to cap my portfolio positioning at 2.5 to 5%. The dollar amount of your total portfolio isn’t a consideration here. Whether it’s $1,000 or $10,000, the standard rule of thumb is you never want to risk more than 2.5 to 5% of your total portfolio in any one position.

If you’re capping each asset class at 5% of your total portfolio, you can sleep good at night knowing that even if you lose the whole thing, you’re not leaving yourself completely exposed. As an investor practicing good risk management, you get to play the offensive.

CREATE GOOD HABITS

Create good investing habits for yourself. Take time to plan out your actions. Build a system in advance. When you build a system, you need to build the habits in with it. And, then, most importantly, you have to stick to them. Now, just like anything new in the beginning, it feels awkward. It’s hard, you don’t really get it. But over time, the more that you do it, the easier and easier it is. Habits are what sustain us when we run out of willpower. Willpower is like a muscle. The more that I have to exercise willpower, the more tired that my willpower gets and I start making bad decisions. But, habits allow us to go on autopilot. We want to build habits and systems in our investing. Making habits to stick to your investment plan can become like the habit of brushing your teeth. It takes no thought at all and it just automatically happens.

A great example of this is systematic investing. Every month, I put X amount of my income into investments and they go into these four buckets automatically. Each month, without having to even think about it, I know that 10% of my income goes into my investments, and that 10% gets split up in four different buckets. 50% here, 30% there, 20% there, and 10% there. Right? It’s system. The system I know automatically occurs without having to take any will-powered action. I know once a quarter that I sit down, rebalanced my books, take profits from here, put the profits over there and I do it over and over and over again until it’s just second nature.

STICK TO THE PLAN

The fifth and final tip that you could implement very easily is stick to the plan. Make a plan. Stick to the plan. Mike Tyson says this best, “Everyone thinks they have a plan until they get punched in the face.” I can tell you, firsthand, that’s true because I’ve been punched in the face a couple of times… both literally from training in kickboxing and also figurately through multiple market crashes and multiple bear markets. I’ve also taken some hits with real estate, through the internet stock crash, and the crypto markets downturn. I have been punched in the face over and over and over. It’s not pleasant to take punch, but if you have a plan and you stick to it, you can get through it even if suddenly the prices start crashing and emotions want to takeover.

We know that investors are emotional. If you’re letting emotion drive your decision-making, you can’t stick to the plan. Combat this by making a plan to do regular emotion free rebalancing- just like I’ve talked about.

If you want to be an above average investor- a great investor- it’s imperative to remove the emotion from your investing practices. You need a solid plan, diversification, appropriate risk management, great habits, and noise canceling headphones for anything that will derail you from your best investing practices.

Leave me a comment with any questions that you have. I want to open dialogue about these topics. I want you to be successful.